Credit cards. Ugggg. Just writing out the plasticky words gives me a serious case of “the sads.” There’s no doubt that when used wisely, credit cards can be a fabulous tool for spending and tracking your money. But when you only pay the minimum balance every month there’s a whole mess of growing credit card debt and interest charges to deal with, which can give anyone a case of “the sads.”

Credit card companies love it when you pay only the minimum balance since they earn a lot of interest while you spend years trying to pay off your credit card debt. Many credit card bills outline this minimum balance in bold just to highlight how little you need to pay back to stay in good standing.

But I want you to beat the minimum balance game. So I created the Credit Card Calculator to show you how many years it takes and how much interest you pay by sticking with minimum balance payments. So go grab your credit card statement, find your annual interest rate, and spare yourself from getting “the sads” while time is still on your side.

How to use the Credit Card Calculator:

Step 1: Open the Credit Card Calculator.

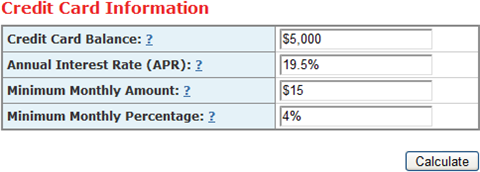

Step 2: Credit Card Balance: Enter the total amount you owe to the credit card issuer.

Step 3: Annual Interest Rate (APR): Enter the annual interest rate charged by your credit card issuer on your balance.

Step 4: Minimum Monthly Amount, Minimum Monthly Percentage: These are the minimum amounts you must pay each month on your credit card. The minimum payment is the greater of these two amounts:

- A fixed amount (for example, $15), or

- a percentage (for example, 4%) of the balance you owe.

Check your credit card agreement to see what formula your credit card issuer uses to calculate the minimum monthly payment you are required to pay on your credit card.

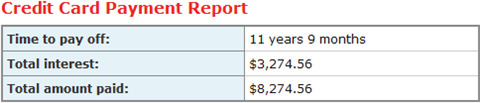

Step 5: Click Calculate. The Credit Card Payment Report displays below. Find out how many years it really takes to pay off a credit card when only the minimum balance is paid. You may just be shocked by how much total interest you’re paying. Hugs.

Use the Credit Card Calculator Payment Report to better understand the true impact of only paying the minimum balance on your credit cards. I’d love to see you beat those credit card companies by increasing your payments by just a bit and thus reducing your credit card debt faster!

More Credit Card Calculator Help:

Got a credit card balance story to share? Have you beaten your credit card debt by increasing your payments? Ever used a credit card calculator to reduce your debt faster?

[…] Credit Card Calculator: Reduce Your Credit Card Debt Faster […]

Credit card debt – ugh indeed. In my younger and more vulnerable days, I worked for a place that never seemed to pay us our paycheques on time. As a result I ended up paying for things like groceries, hydro, phone bill…everything that I could pay on my credit card, on my credit card. All the cash I had, went to rent because I didn’t want to be out on the streets if paycheques went further behind.

My credit card debt racked up. I made the minimum payments, but nothing more. I knew better, but I felt like I had no choice.

Eventually my brother ratted me out to my dad, who went to the bank and paid it off in full, which totally did not teach me any financial lesson whatsoever. What he did afterward, did, though. He made me pay him back, plus the interest he’d have gotten in a savings account, over the course of 6 months. “But I am not getting paid on time! It’s not my fault,” I complained. “Then find a new job at a more stable company” he suggested “My terms aren’t changing.” I found a new job. I paid him back, plus interest in 6 months. I now use credit cards for convenience, not credit. My dad likes to tell this story at cocktail parties, as a cautionary tale to young people.

@Beth Yours is an amazing story. I really love how your dad helped you, and made you pay it back. I would love to know how your brother found out about your debt. 😀

@CindyS IT IS SCARY! In the example I showed how it takes 11 years and 9 months to pay off a $5000 balance with just a minimum payment of $15 a month. That’s over 11 YEARS with about $3,300 payed in interest! YIKES! And this doesn’t even include adding to the balance. Scary.

Fox, this is soooo cool and kinda scary! I’m going to have to share it with a few people, mostly my children who think nothing of putting everything on a credit card.

Famous money quotes edition of the COPF…

…So these are some of the best articles from around the web about a variety of money topics. I decided to add a few of the more famous money quotes out there to spice it up a little……

[…] Squakfox – This blog is full of frugal living tips to help readers learn “how living simply, spending wisely, and investing intelligently impacts your health, wealth, and self.” The author offers a few tools, too, like the “Credit Card Calculator: Reduce Your Credit Card Debt Faster.” […]

Credit Cards are evil. Everyone pays for the convenience. The retailer pays, the consumer pays and society pays. The best thing to do with your credit card(s) is burn it(them).

The next thing to watch out for is your debit card. Check out this link to a series on debit cards on PBS!

http://mikehassard.blogspot.com/2009/09/debit-card-financial-card-game-kelowna.html

[…] But I chipped away little by little and managed to get rid of my credit card debt. Do you have credit card debt? You can get rid of yours […]

[…] updates on this topic.The question comes up all the time when a person wants to start getting their credit cards under control – Pay off the cards with the highest interest or the cards with the highest balance?On the […]