Do you know how much your investments are costing you? I wouldn’t be surprised if you didn’t. I was pretty clueless waaaay back when I started investing my hard-earned cash in a basket of mutual funds — they came highly recommended by a friendly financial advisor, after all.

And fees? What fees? My financial statements didn’t tally any fees for me to be concerned about, and I never wrote a single check to my advisor for her services. So where were all the fees? As far as I could tell, my investments were fee-free. Awesome!

What wasn’t awesome was the day I read an article similar to this one: Do fees really matter? In this article, financial journalist Duncan Hood argues that paying a single percentage point more in fees can cost most portfolios tens of thousands of dollars in lost savings. That much?

No way. Not possible. Never. Nope. Ok, I was in denial. So I did some financial fee sleuthing, number crunching, and nearly chocked on my myriad of mutual funds. It turns out I was paying fees. A lot of fees. A smorgasbord of fees that was slowly, and stealthily, devouring my savings and consuming my portfolio. WTF? (Yeah, What The Fee?)

Anyways, my gut-busting numbers mirrored those in the article’s math — indeed, paying one percent more in fees really was hosing my savings. Don’t believe me? Let’s do some simple mathy math that won’t cause your eyeballs to roll back into your head. Promise.

Fees: A tale of two mutual funds

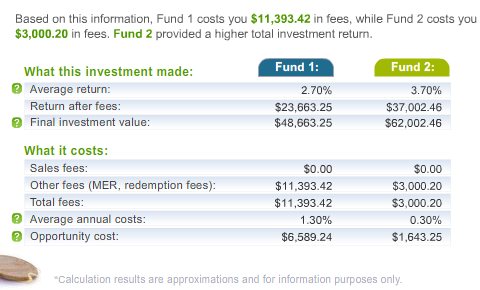

Ok, let’s assume you’ve invested $25,000 for 25 years and managed a pithy return of 4%. Now let’s look at what happens to your delicious savings when they’re invested in two different mutual funds: Fund 1 boasts a hungry fee of 1.30% while Fund 2 chews one percent less at 0.30%.

Results: Over 25 years, greedy Fund 1 consumes $11,393 of your cash in fees, while Fund 2 costs just $3,000. Which portfolio would you rather retire on — the one devoured by fees at $48K, or the one barely tasted at 62K? That’s the price of one percent, people.

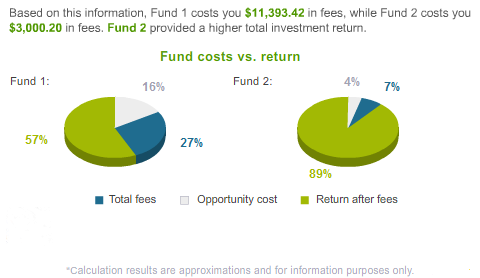

Now take a peek at this chart for another perspective, and see how much pie is gluttonized (new financial word) by one single mutual fund fee, called the Management Expense Ratio (MER).

Do you want more pie for yourself? Time to learn about your fund fees.

Investing Fees: I see where you’re hiding!

A quick tour of the greediest fees lurking in your portfolio.

1. Management Expense Ratio (MER). It’s called a MER. Saying it out loud sounds a little like cooing in your lover’s ear. But I assure you, the only ones cooing over this lovely fee are your financial advisor and fund company. That’s because whether your mutual fund makes or loses money, you’re still paying a percentage of that fund’s value to cover administration costs, management, and perhaps trailer fees paid to your financial advisor. The MER charged can range between fund companies and countries, but I’ve seen anywhere from a super low 0.07% to a super high 5.50%. Yep, the MER can be an expensive fee if you’re not watchful. The less MER you pay, the more money you keep.

2. The front-end load. This sales fee will shave a little off the top when you purchase a fund, right before the money is invested. So investing $5,000 with a 2% front-end load costs you a cool $100 and leaves $4,900 invested. Poof, your money is gone.

3. The Deferred Sales Charge (DSC). Do you like wearing handcuffs? Then welcome to the DSC, also called a back-end load, where you’re charged a hefty fee for selling your fund before a certain number of years, usually 6-7. Investing in a fund with a DSC handcuffs you to that fund and perhaps the advisor, because it can be too expensive to pay several percentage points to get out of it. I fell for this killer fee once, but never again.

4. Trading costs or commissions. Selling or buying funds at a rapid pace will cost you dearly in commissions. Consider the commission cost before buying a financial product with only a small amount of cash — you could be paying a hefty commission with a humble investment to show for it.

5. The annual account fee. Newbie investors with smaller accounts should pay close attention to their annual account or administration fee. Always ask to have a $25, $50, or $100 annual fee waived if you’ve only got a few hundred or thousand bucks saved since that fee will eat into your return.

Where to find your fees

Financial disclosure of investing fees varies around the world. Some countries protect their people with stiff rules and regulations, so you may see your total fees paid in dollars on your financial statements, rather than stated as a percentage of the fund. Lucky you!

Since I’m Canadian I speak from my personal experience, and financial disclosure is the pits here in the land of EH! — that’s why I was clueless about the actual amount of moolah (in dollars) I was paying in fees eons ago. So I learned to do the math. To best protect yourself, it’s a smart financial move to READ each fund’s documentation and use that knowledge to find your total fees paid.

Every fund you purchase comes with documentation. Here’s where to find it:

1. Ask your advisor, fund company. Your financial advisor or fund company should be providing you with investment fund documents (such as a mutual fund prospectus) detailing each fund’s holdings and fees. Also, check your fund company’s website for this vital information — it may be available online for download.

2. Check with Morningstar. Surf on over to Morningstar for snapshot information on all sorts of financial products, such as stocks, ETFs, and mutual funds. Americans can use the tools on Morningstar.com while Canadians can access fund information on Morningstar.ca.

3. U.S. Securities and Exchange Commission. Americans can use the SEC’s Search Tool to lookup mutual fund prospectuses.

4. Canadians can use SEDAR. If you’re a Canuck and you’re stuck looking for a fund’s details, try the SEDAR Search Tool. Filing securities related information on SEDAR is mandatory for most reporting issuers in Canada.

Investment Fee Calculators

Now that you’ve got the numbers, use of these handy tools to total your fees paid. Yes, you can do it.

- For those looking for a quick tool, try my Portfolio MER Calculator — it’s perfect for tallying the average MER on your entire portfolio as well as the total yearly expense incurred. This handy financial tool may just inspire you to find lower-cost investments!

About those fee calculations…

Don’t be surprised if your fund fees are much higher (or lower) than those in my examples. Investing fees can vary greatly between countries, among fund companies, and within fund classes. Canadians should pay special attention to their mutual fund fees though — a recent Morningstar report shows that Canada pays the highest fees among the 22 countries surveyed.

“The report found the median asset-weighted expense ratio to be 1.31% for fixed-income funds, 2.31% for equity funds and 0.80% for money market funds.”

— Morningstar Grades Canada an F in Mutual Fund Fees, Moneysense Magazine

I’m the first to admit that investment fees can be a tough subject to face up to. But it’s important, so please do it. 🙂

Question: Ever get bitten by these investing fees? What have you done about it?

Great post Kerry. Fees can really be a killer and often, as you say, clients are not aware of these costs.

I just had a client who sold an mutual fund with a DSC after holding the fund for only a year. It cost the client 5% of their investment to get out of it.

I had another client who needed their money in one years time, yet the advisor invested the money in a DSC equity mutual fund. Not only did they have to pay the DSC but the mutual fund had lost over 10% in the years as well (some of that lost was attributed to the MER).

Bottom line, find out the costs of your investments and are they suitable for your investment purpose and time frame. If you not sure how seek the help of a money coach or fee only financial planner who can give you unbiased advice as they do not make money by selling investments.

Better still look for an advisor who charges fees and doesn’t buy mutual funds and get caught in the MER”s. My advisor charges a small percent of my holdings so when I make money so does he and when the funds go down his compensation goes down and all the information is right up front. The fee charged decreases as the assets in my account grow. I think this will be the way of the future.

Blessings Cynthia

Excellent piece, very comprehensive resource.

WRT fees. I don’t think advisors should be compensated on assets under management, client net worth, or even directly on the performance of investment recommendations. The best advisors are independent and will only be compensated by a fee for the planning services you agree upon. Any other method is filled with bias. If the client is not satisfied then they will not re-use the services of that advisor. The client is not tied to an advisor this way.

[…] Squawk Fox lets us know about 5 investment fees that devour your savings. […]

Delightful article! The way it’s written makes it easy for new investors to understand and old investors who lived in lala-land all these years to cry.

I would take it a step further and bring up the fact that 90% of the funds that charge over 2% commission don’t bring any higher return than the index funds and ETFs that charge .20% or less.

It’s like paying your adviser to lose your money!

Great advice, Squawkfox. I’m getting into the DIY part of investing myself, specifically so I can get away from high MERs, especially since the introduction of the 12% HST applied to investment services. Just wondering, what websites or books do you recommend for investment research?

Love your blog and your dog. Keep the great posts coming!!

Great article for the new investor and the long time investor who has probably never had the real conversation of the impact of these fees.

Fee’s are treated so nonchalantly as if they are a matter of fact.

Although, I agree with all the other comments, does anyone know of an advisor/ company that works on a pay-per plan basis?

I think that was the only thing missing from the article was what’s the alternative to the current investment options.

Cynthia and Hunter have some interesting alternatives…hope they could share the who they use provides them.

Thanks again.

Alex: I work with a fee-only planner who concentrates on low cost investing. Please let me know if you are interested in interviewing him.

As a financial advisor I found your article interesting but very one sided. If you have an advisor that is only looking after your investments he or she is only doing 1/6th of their job. I’ll agree that there are a lot of bad advisors/companies in this industry. As a financial advisor I do advise my client to invest in mutual funds along with other options, but I also disclose up front before they invest a dime about the MER’s and how they work; I also disclose the options of DSC and No-Load funds. I want to make sure my clients know what I get paid for and how I get paid.

A financial advisor is much different than an investment advisor. A financial advisor should help with cash and debt management strategies, develop an adequate level of income and asset protection, implement tax reduction strategies, help keep you on track for your goals, assist with estate planning and transferring of wealth to heirs.

I want to be the go to guy for my clients, if they have a problem or question I want them to call me; that is part of my practice. If they need advice on a financial issue; or want to know how a decision might impact their plan; or need a referral to someone trust worthy in another industry I want them to feel comfortable calling me to talk. I know people that are with fee for service advisors, and they don’t want to call them (even on some big issues) because they know a bill is attached to that phone call.

I agree that a little more transparency in the industry is needed and I’m sure we will see it in the future but there are many of us that go above and beyond what is required with regards to being transparent about fees and commissions.

In my mind the question of fees is only an issue when you don’t see value for what you are paying for.

Thank you for exposing one the most important hidden pitfalls to successful investing. Most investors don’t pay enough attention to realize they are slowly losing their returns. It is the percentage (%) fees, mostly in expense ratios and management fees, that are really killers. Investors who self-direct there investment can eliminate almost all of these damaging fees.

Ken Faulkenberry

[…] SquawkFox is just awesome. No other word to describe this website. I would love to sit down for coffee and chat with the minds behind SquawkFox. They are able to jam pack a wide variety of content (recipes to finance) into one site. Most sites would be crushed under the pressure but not SquawkFox. They flourish and create stunning content that is breath takingly awesome. Which brings me to my favourite post this week from SquawkFox, 5 Investing Fees that Devour Your Savings. […]

I and my spouse were duped as well into purchasing DSC funds (7 yrs) but ours are coupled with a high MER (in the range of 2.5%). Never again! Would anyone suggest that we’re better off selling these off early and paying the DSC to get away from the high MER or would we be better off holding onto them despite the high MER? Is there an easy way to calculate this?

Love you articles,

DSC/MER Duped

Awesome post! I feel like people are still oblivious to the fees they are paying inside their 401ks and iras. the graphs you provided make it obvious that even a small percentage can have a huge effect on your overall investment. That 12% mutual fund that everyone is claiming to have found is looking less and less likely with fees involved.

awesome article! i recently watched a youtube video on the hidden fees associated with 401ks and it was very eye opening – thanks for the visual graphs!

sorry about that didn’t mean to post twice….it gave me an error the first time so i tried again.

Ok fine, Ms. Fox. I have finally come up out of denial to look at what has happened for the last 15 years and I am appalled. I think I just fired my advisor (who is nothing like Jay who posted above). I think I am looking at beginner index funds. I am going to tread carefully over the next year (my 40th) then begin anew with more aggressive investing. The trick is the ethical part… but I will learn. But do you have any hints for SRI index funds? A fan needs your help.

Christine: Hugs. And kudos to you for looking at the numbers — never easy. Are you Canadian, American, or hail from another place?

I am basically your neighbour (note the u in there). I have read through all your notes, several times, and think I understand most of it. I looked at the ING streetwise, and I think the MER has been lowered to .80, which makes it more reasonable as an alternative to the more hands-on TD e-series. That’s what I meant with beginner index investing… I am going through the prospectus and trying to find which funds invest in companies I don’t want to be a part of…

I want to change but have no idea where to start. Where do i go? where do you get index funds or ETF’s?

Also, should I open a tax free savings account and can that $ be invested where ever you want, or does it have to be with your bank? As you can probably tell I’m just beginning to educate myself and I need to know how to do things. Help?!