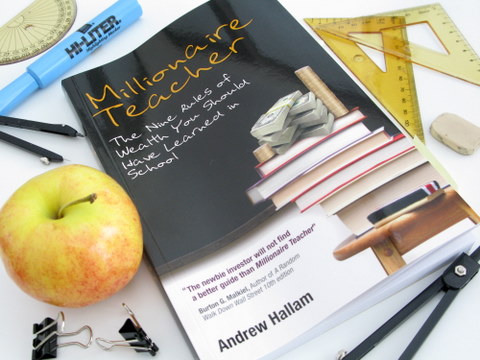

This is a review of Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School by Andrew Hallam.

I met Andrew Hallam by accident in my email’s spam folder. It’s a bad day when a notable financial writer (and a super nice guy) gets banned from my inbox along with thousands of spammers.

In Hallam’s case, I found three. THREE REAL EMAILS! That’s like a million spams to one Andrew Hallam. The odds were against him.

Now, you wouldn’t think that Hallam, a high school English teacher, would take a lot of stock in playing the odds. It’s the math teachers, after all, who spend their days calculating Calculus formulas, integrating integer ratios, studying statistics, and perhaps dabbling in a little bit of probability theory.

But Hallam isn’t your average English teacher. He’s a millionaire. And he became a member of this elusive club by being a bit of a numbers guy.

“I didn’t take exceptional risks with my money and I didn’t inherit a penny from anyone,” he writes in his book. “When I went to college, I paid the entire bill myself. How did I pay for my own schooling and amass more than a million debt-free dollars before my fortieth birthday?”

Hallam poses good questions. After reading Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School I now know the answers.

Raise your hand for a little money advice!

Money is a taboo subject, and schools haven’t done much to untabooify (new financial word) the wacky world of personal finance. Heck, many high school teachers wouldn’t know where to start! That’s why a bunch of them banded together and asked Hallam for money help. The teachers wanted to know how best to save, invest, and prosper like the millionaire English teacher.

Hallam, being a generous kind of guy, started clubs and taught his fellow teachers his money ways. Being a finalist in the National Publishing Awards for financial writing, he is known for his penny-wise prowess.

It was within these clubs Hallam learned first hand how the majority of money books fail to connect with real people — you know, human beings. Written by economists and other super-smart people, too many investing tomes use jargon and financial language that barely skims the minds of well-meaning folks.

So with the help of over 100 colleagues and friends, Andrew went on a mission to bring his money lessons and rules to the masses. Jargon-free, fun to read, and easy to follow, Millionaire Teacher is the book that could take you to the head of the class and add a few zeros to your portfolio.

Millionaire Teacher: The ‘Nine Rules’ you didn’t learn in school

You won’t find any ‘get rich quick’ schemes here. Hallam is a practical fellow who believes in hard work. He advocates a sensible savings strategy, steers clear of the financial service industry (many advisers charge hidden fees), and invests in low cost index funds to grow his modest income into unimaginable wealth. He shows you how to do it.

I won’t review every rule in Millionaire Teacher — I don’t think I could do each chapter justice. But the rules that resonate strongest with me are as follows:

Rule 1: Spend like You Want To Grow Rich

Readers of Squawkfox will love the first chapter, since Hallam outlines how to be frugal without becoming a miserable miser. Hallam has a witty sense of humor about choosing to live on less, and shows you how to live life to the fullest while not spending buckets of money.

Rule 5: Build Mountains of Money with a Responsible Portfolio

I’ve always been great at saving money. But after paying off my student debt, I had little clue how to invest. Enter chapter five, where both newbie and intermediate investors can benefit from Hallam’s down-to-earth explanations of stocks, bonds, and those newsworthy market movements.

He shows how you can build wealth over time by investing in low cost index funds and building a ‘Couch Potato Portfolio’. And yes, everyone can do this!

Rule 6: Sample a ‘Round-the-World’ Ticket to Indexing

Rule six makes this book worthy of the international audience who reads this blog. Whether you live in the U.S., Canada, Australia, or Singapore you’ll find huge value in this chapter since Hallam outlines possible funds to invest in.

Read this chapter at least five times. You’ll learn investing lessons from the American section even if you are a Canadian. If you hail from Australia, the Canuck section is eye-opening. Even the personal stories Hallam shares throughout the Singaporean indexing part are enlightening to an international readership. Really!

Why More Stuff Won’t Make You Happy

An interview with Andrew Hallam where we talk about Millionaire Teacher. 🙂

Who should read Millionaire Teacher?

Whether you’re a newbie saver or an advanced investor, this is a great investment book for all levels, ages, and incomes. I love Hallam’s accessible style — he’s fun to read AND he explains challenging financial concepts in an understandable way that’s rare in personal finance books.

Love, love love

Kerry

Wow! Thanks for such an incredible review Kerry. I’m going to send you an email, so please pick me out of the Viagra pile.

I am new to the personal finance world and I just finished reading Andrew Hallam’s book last week. It is the best finance book I’ve come across. His writing style is accessible and the concepts are empowering because you don’t need an advisor to make educated decisions about your own money. I can honestly say that I’m excited to start investing now that I have a plan. Thank you Mr. Hallam.

Laura,

You’ve made my day! I’m thrilled to read this.

Cheers,

Andrew

Andrew you are an inspiration. I have mutual funds which have lost money and yet even when my market price is less than the book value the fund manager has made his cut. I have been anxious to find an explanation in “laymans” terms so I can think about a different direction.

Thanks

Hi Heather!

I’m so glad to hear that. The best part is knowing that you now have the knowledge to help some of your friends–teaching them that the best statistical option is the low cost option. Thanks for the kind words Heather!

Andrew

I’m looking forward to getting Andrew’s book from the library. Huge waiting list.

How much did living in Singapore help him amass his fortune? I taught in Hong Kong for many years and benefited greatly from the flat rate income tax of 16% and absence of capital gains or consumption taxes.

The world may need more Canada, but Canada definitely needs more Hong Kong and Singapore!

Hi Mike,

I’m sure that living in Singapore over the past eight years helped me quite a bit. My marginal tax rate is only 15% over here. But it’s the lessons within the book that I wanted people to benefit from most. And I did my best to ensure that those lessons were international, yet specifically international, with a section for Americans, another section for Canadians, a third for Australians and a fourth for Singaporeans. In fact, any country with a brokerage could follow the investment strategies (as I suggest within the book) using ETFs.

Great post! You’re not the only blogger who has been enthusiastic about this book. I’m now on the waiting list at the library, but I may just “splurge” and buy it (using a gift card bought at discount, of course!)

Hi, Mike.

I just moved to Switzerland recently. Although it is not an English-speaking country, would you happen to know if your book’s international section would be helpful to me? My income tax here is 9% which is much lower than it was in Hong Kong (my previous residence). Cost of living is higher than most countries and my health care premiums cost about 3% of my gross income. However, my income is higher than what I would make in most countries for my line of work and I am committed to being frugal. Saving her is definitely possible. I am looking for the next step….how to invest as an international (expat) without having to spend a fortune of financial advisors. I am quite ignorant of how to invest so am quite worried about making mistakes with my savings.

Al

Even with common sense and hard work, becoming a wealthy barber is impressive. Becoming a wealthy teacher is just inevitable.

As a Canadian like yourself Andrew, im wondering why you spend most the book talking about US investing and not Canadian investing?

I did enjoy the book and learned lots about index investing!!

[…] Kerry eventually read my book and recommended it to her 36,000 readers. Here’s her review. And you can check out Kerry’s cool financial book here, 397 Ways To Save […]

I’m always looking for books that I can recommend to my clients that aren’t financial gurus. I’m excited to check this one out! Thanks for the recommendation!

LOL agreed and very well said but I’ll read the book nonetheless. Wealthy barber broke it down like no other book. Public servants in Canada get paid well and have more to throw around so point taken.

Joe FEBRUARY 6TH, 2012

Even with common sense and hard work, becoming a wealthy barber is impressive. Becoming a wealthy teacher is just inevitable.