The best way to pay off debt is to stop thinking about it and just do it. But what if your brain is stuck on the “thinking” part, preventing you from acting on a repayment plan? Time to use a little behavioral science.

“The biggest hurdle is that people have to try and change their behaviour,” says Dr. Melaina Vinski, Behavioural Insights Lead for PwC Canada. “If you understand why, it gives you the power to be able to take charge and change your behaviour for the betterment of yourself and your family.”

As a behavioral scientist, understanding the challenges of changing human behaviour is Dr. Vinski’s speciality. I asked her for some advice on how best to tackle our growing debt issues with behavioral economics – the study of how mental shortcuts can lead to biases and predictable patterns in life and money decisions.

Beware of the ‘Ostrich Effect’

The first challenge to paying off debt is to find a way to face those bills.

“If we know we’ve spent a lot of money that month, it’s really hard to check a credit card bill in the mail. We tend not to open it,” says Dr. Vinski. “We call this the ostrich effect, where people have a tendency to bury their head in the sand, even though that means we’ll pay even more interest. We don’t want to look and see what that number is.”

More behavioral science: Behavioral Economics: Rewire your brain to master money

There are two behavioural tactics that can help you overcome your bill-opening fear.

“Get automatic statements from the bank, so it’s a message that automatically comes into [your] email instead of the mail,” says Dr. Vinski. “Another thing is writing into your calendar ‘check credit card bill’ when you know its due, and then you’ll be more likely to check it.”

Loss Aversion: Increase the pain of payment with cash

Which shopping scenario makes it easier to spend: Paying cash at a physical store, or ordering online with a credit card? Most people find it easier to charge online due to a behavioural bias called loss aversion, in which we’re more motivated to avoid losses than to attain gains.

Related: What Order Should I Pay Off My Credit Cards?

Behavioral science and loss aversion suggest that paying with plastic doesn’t feel like we’re parting with money, so a way to reduce spending could mean making a switch to cash.

“A big reason why people don’t end up saving money is because every transaction doesn’t necessarily stand out. Your money leaks out of your wallet or your bank account in a lot of ways that we don’t really remember because it almost seems redundant,” says Dr. Vinski. “You can still use the Visa for big purchases because they’re significant and we remember them – like buying a couch or buying a TV.”

Related: Getting out of debt with the Debt Reduction Spreadsheet 2019

Behavioral Science: Look to the future with a commitment device

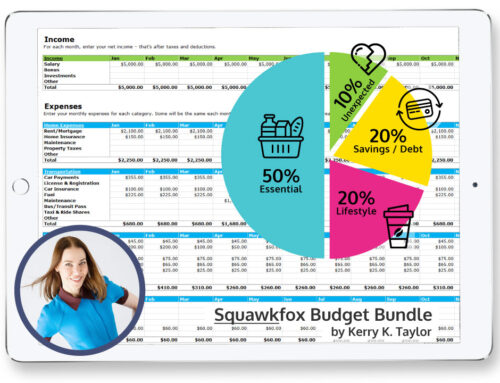

To plan ahead for a debt-free future you need two things: a plan and a way to get over a behaviour called the present bias – the tendency to overvalue immediate rewards at the expense of long-term goals.

Choosing to spend $25 today on fun stuff over contributing that money to an RRSP or paying down a student loan is an example of how present bias can work against us when trying to increase savings or reduce debt.

There are two tricks Dr. Vinski suggests to help overcome a present bias to financially benefit your future self.

The first is “setting a default”, or making a scheduled automatic payment every month to tackle debt or build savings. The second is to use a behavioural science technique called a commitment device, a way to lock yourself into following a plan that’s good for you tomorrow despite being hard today.

“Look back over three months of data to see where you are spending money and what isn’t essential. What can be given up? Come up with those items and put them into a ‘I will not do X, Y, and Z list’,” she says.

“The commitment piece would be at the bottom of that page where you sign it and say, ‘Yes I will not do these above actions,’ and have somebody that can hold you accountable sign it.”

Share your commitment for debt reduction with your parents, partner, or best friend to help you achieve your goal.

More behavioral science: Money Goals: How To Set Financial Goals That Slay

“Commitment devices are habit breaking so it’s good for getting people to eat healthy, to go to the gym, and it’s been shown to be one of the best ways to get people to contribute to their long term savings goal.”

And if you slip up?

“We live in a different environment than when our brains were built, and this is the consequence of it. There’s a reason you’re doing this, and it doesn’t make you not human, it makes you very human.”

Love love love,

Kerry

What perfect timing for this article to come to my mailbox. I’m on the path of starting a personal finance blog and I was just thinking about how knowledge is important but what really takes things to the next level is actually making the change. So the question is: how do we successfully change habits? Thanks for the article and as it definitely has me thinking.

Very happy to see this. As a single parent it always seems to be a situation of robbing Peter to pay Paul. Thanks for this focus on changing behavioural patterns. Keep up the great work.

Loved reading this! Strategies are everything, as I head into investing.

Thank you so much for this post, i can feel how pressured it is deal with debts, you have explained it beautifully by mentioning about how we can handle it mentally. I really enjoyed your post. Keep posting.

The easiest way to get out of debt according to me is to make much more than your expenses and even much more than the debts in place themselves.

This article is fantastic and i got some good information by reading this.

thanks a lot.

Hi! Thanks for this post. I love a good strategy and only really got to grips with debt when i put a plan in place and got on with it.

Thank you 🙂

To conquer debt, you must have a battle mentality. I also recommend the snowball approach to pay off debt to keep morale high.

The “Ostrich Effect” is really on point. It’s easy to ignore over-spending. Ignore and deny over and over and eventually we wake up and wonder why we didn’t save more. Thanks for sharing!

Perfect post. You definitely received the loss effect with cash. It’s just something that makes me calculate every penny before I spend when I’m dealing with cash. In addition, breaking a $20 bill feels like torture…With the credit card, I’m way more flexible lol. Now I know why.

Well Put and it has come out awesomely. Thanks a lot for putting across this, its gonna help greatly

Perfect post! Love the way you explain the psychology of debt. Thanks for the great tips!