Ever wondered how much money you need to save every month to become a millionaire? Or maybe you’ve dreamed of reaching a savings goal in a matter of years? I know I sure have.

To help you count the days before you’re a mega millionaire, I’ve put together the Savings Calculator to get you reaching your money goals sooner. Depending how how much you’ve got saved today, it may be a matter of months or several years before you’ve got enough dough saved to buy a car, buy a home, or even retire! The Savings Calculator is a fun tool that shows you how every dollar saved gets you closer to money saving nirvana.

If you need some ideas to help you get even closer to your savings goals, check out 50 Ways To Save $1,000 a Year. There’s nothing like FIFTY money saving tips that help you to painlessly stash some extra cash without losing a limb or getting a second job.

How to use the Savings Calculator:

Step 1: Open the Savings Calculator.

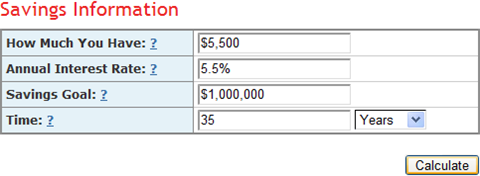

Step 2: How Much You Have: Enter the amount of money you have saved today.

Step 3: Annual Interest Rate: Enter the average interest rate for growth of your savings. This number is compounded monthly.

Step 4: Savings Goal: Enter your saving goal amount. Go ahead and enter a million bucks! Dream big!

Step 5: Time: Enter the number of years or months you have to save. Play around with this number to find a monthly savings rate that is sane for your lifestyle.

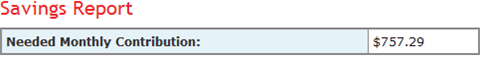

Step 6: Click Calculate. The Savings Report displays below and shows your Needed Monthly Contribution to meet your money savings goal.

Also, find out how many years it will take you to become a millionaire! Just be sure to send me your best when you’re sunbathing in Bora Bora!

Do you have what it takes to become a millionaire? Got any tips to help others stick to their long-term savings goals?

@Sagan LOL Well, you can’t count your moolah if you don’t do the math. 😀

There are calculators for EVERYTHING!

Love it 😀

The way the US is printing money these days, I should be a millionaire by, oh, next week. 😉

Kidding. But inflation has to enter the equation.

$1M in 2035 (about when I’ll be reaching retirement age, God willing) won’t mean much.

Uh oh…. I have to save $152,749.87 a month to reach my $10 Mil goal by age 40. Although, this calculator doesn’t account for the passing of rich relatives…..

This is really fun. Although the taught of reaching 1 million is quite fun, I reduce the amount to 150 000$ (the amount I need to live for dividend just like Derek Foster). I already have 50 000$. I want to retire in 5 years at the year of 34 just like… Derek Foster… lol AND… This is fantastic, at an interest rate of 8% for the next 5 years, if I save 1024,64$ per month, I might be able to do it! THANK YOU 🙂 Very fun tool! It help to make us believe in the financial freedom dream. If the dream still possible..

Very cool…thanks for sharing this. I think it will help me stay focused on my savings!

Now it’s just a horrible waiting game. Great tool though.

Two questions:

1) Are people inputting the value of the equity in their homes in this?

2) What are people using as the interest rate?

I tried it with the equity and 6%, as that’s what I remember Buffet saying the markets will likely return, but then I thought I don’t know if my house will go up that much…

DavidV,

I’m assuming you purchased your home because you wanted to enjoy the benefits of home ownership and you liked the house you bought. Unless you own an investment property (rental), you should not think of your primary home equity as an active investment from a money growth perspective. It’s really a polar opposite to savings / growth accounts such as GICs, stocks, bonds etc. You can “live” in your home, you can’t live in the others. Up’s or down’s in value aside, you gotta live somewhere. You should however add it when calculating your net worth.

Of course it will appreciate and depreciate from year to year but you’ll only benefit from any gains when you need to sell. The proceeds will probably go towards retirement residence fees lol.

I’d run the calculator without the home equity factored in.

FWIW,

Bill

So simple. To bad this calculator is for dreamers. No one can predict one’s rate of return. Don’t people read the disclaimer on investments saying historic performance does not guarantee future performance?

Great information. Great blog.

Unfortunately many are still feeling stung by the downturn in the markets, job market and home prices.

The key is behavior …paying off your debt, paying down your mortgage and investing. Keep making the right decisions in these uncertain times.

Warren made his start in the downturn in the mid 70’s. Things recovered then and they will agian.

This too shall pass.

Keep up the great blog.

Great tool, though the output is a little depressing. I’m going to double-down on my Lottery ticket purchases every week.