Looking for a little summer romance? Have a summer fling with saving money and you won’t have the heartache of breaking up after Labor Day. Smile.

I don’t fall in love often. The last time I succumbed to Cupid’s danged arrow was in 2001, when I met ‘The Carl’. Oh gush. Anyways. Fast forward 10 years and I’ve got the gush again, but this time it’s for a little calculation called the Personal Savings Rate (PSR).

Now, I’m the first to admit that comparing Cupid with a mathematical calculation is weird. But by the end of this article, I want you to see the value of knowing your personal savings rate and loving the idea of raising it high into the skies. Schwing!

Most of us are lousy savers.

You may be great in bed, but are you a great saver? Years of data suggests that North Americans are lousy at saving money (I can’t find any decent data for what happens between the sheets). Anyways, over the past 20 years Canadian households have seen a steady decline in savings, according to a recent study by the Vanier Institute of the Family. In 1990, the average Canuck household saved $8,000, for a savings rate of 13.0%. In 2010, that number dropped to 4.2%, averaging just $2,500 per household.

And Americans are just as lousy — at saving. Looking through the vast data published by the Bureau of Economic Analysis, American personal savings rates peaked in 1975 at 14.6%, hit rock bottom in 2005 at 0.8%, and sit at 5.5% today.

Really? Sure, times are tough and the economy stinks, but I think we all could do a little bit better, right? Knowing your own personal savings rate is a great place to start. Ready to get a little naked with your finances? Take these five steps for a spin to get up close and personal with your savings rate.

Step One: Total your monthly income.

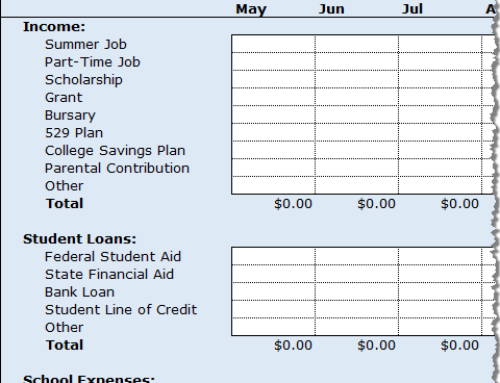

Gather up your paystubs and take a good hard look at what you bring home every month. Add up your after tax income, bonuses, tips, commissions, and any other money you earn from a second job or a side-hustle gig. I work a few odd-ball jobs at the local farmer’s market over the summer months, so I use my Extra Income Spreadsheet to keep track of this cash.

When Carl and I first started this exercise, he got a little lazy by just adding up one month’s income. The results were bunk since he makes more some months, and less others. So add up at least three months worth of income (more is better) to get a good view of what you really make on a monthly basis.

Mathy Math: Add up three months income (after taxes). Divide by three to get your monthly income total.

$2,600 + $3,120 + $2,200 = $7,920

$7,920 / 3 = $2,640Total Monthly Income = $2,640

Yeah, I love adding up my income too. This was the lovely part.

Step Two: Total your spending and expenses.

This is the part where Cupid’s arrow goes a little limp. Sorry to be a mood killer, but it’s time to be very very honest about your spending habits. How much money do you spend each month? What are your expenses? What do you spend your cash on? Are you hiding purchases from your spouse? Do you have a secret stash of cash for buying s$it? Yeah, raise your wallet if your halo slipped and your wings are clipped. Poor little Cupid.

Over the years I’ve written reams of stuff on how to track your spending and tally the costs. For an angel’s eye view, tally at least three months worth of credit card bills, bank statements, mortgage payments (or rent), and shopping receipts to get your monthly spending total. Don’t forget to include debt repayment costs, and semi annual (or annual) expenses like home insurance, life insurance, dentist visits, and trips. The real angels in this exercise will tally six months of bills for a realistic spending picture.

Mathy Math: Add up three months of bills and receipts. Divide by three to get your monthly expenses total.

$2,500 + $3,200 + $2,100 = $7,800

$7,800 / 3 = $2,600Total Monthly Expenses = $2,600

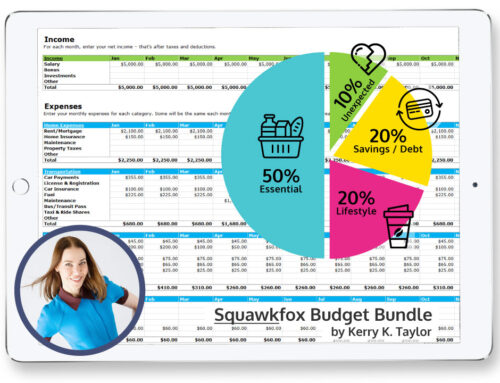

Download the free Budget Spreadsheet to help total your expenses. The Debt Reduction Spreadsheet is a handy tool for those who need to track their debt repayments.

Step Three: Calculate your savings.

With the tougher math behind us, it’s time to calculate your savings. The real test is how well you tallied your income and totaled your expenses. Not sure? Then review steps one and two before moving on!

Mathy Math: Subtract your monthly expenses from your monthly income.

$2,640 – $2,600 = $40

Total Monthly Savings = $40

Are you feeling the love yet? Those with positive bucks in the bank may be feeling smug at this point, while those sitting in negative territory are down in the dumps. Either way, don’t rejoice or dismay too much — the real value in this number is what you choose to do with it in the future.

Step Four: Find your Personal Savings Rate.

Time for the magic moment, people. Are you flying high with halos glowing or digging in the dirt with a pitch fork? Go ahead and plug your numbers into the Personal Savings Rate (PSR) equation:

Monthly Savings / Monthly Income = Savings Rate

Savings Rate x 100 = Personal Savings Rate

Mathy Math: Divide your monthly savings by your monthly after tax income. Take the result and multiply by 100.

$40 / $2,640 = 0.01515

0.01515 x 100 = 1.5%Personal Savings Rate = 1.5%

Do you have a positive number, a negative digit, or the big goose egg? Regardless of your result, keep moving forward.

Step Five: Improve your score.

Ok, so why the heck should anyone love this dang number? This math stuff doesn’t exactly send the sparks flying. And eating chocolates, smelling flowers, and blowing kisses into the wind is way more fun, right? Well, think again. Turns out that the winged boy slinging arrows in all directions should really slug us with a balance statement every now and then, ’cause nearly half of all couples fight about money.

The New York Times reports that Money Fights Predict Divorce Rates, CBS says 45% of all couples fight about money, and Glamour Magazine (cough) says the proportion of couples who dish about dollars is closer to 43 percent.

So maybe, just maybe, taking the time to tally all these simple calculations could give you a shot at saving Cupid? And perhaps including your spouse (or partner) in the number fun would improve your relationship too. Did a bell ring? Did an angle get its wings?

Could greater savings increase a person’s happiness, and keep a couple closer together? Sure, why the heck not?

How to increase your savings rate

You know your score. You may even know your partner’s score. So now set yourself the goal of exceeding it by aiming a little bit (or a lot) higher. For example, a Personal Savings Rate of 1.5% is a start, but cut a little spending to raise that sucker to 2.0 percent. Download these Three Financial Goals Worksheet for some direction on how to set money goals.

Lastly, this whole blog is about cutting costs and finding savings. Pick any post, and save a few bucks. Pick this post: 50 Ways to Save $1,000 a Year, and save a lot more. I’ll leave the Cupid stuff up to you. 😉

Your Thoughts: Do you keep track of your savings? How?

@Lance I agree! It’s the savings game. Hmmm, maybe I should write about it. 🙂

It’s like a game for me, seeing how I can increase the PSR!!!

What a great article. I love how you can take old concepts (an really important ones at that) and make them fun and interesting. Everyone needs to read this and more importantly do this!

Jim

It seems a lot of people taking part in the pole are super savers with their PSR over 15%. I’d like to think that my PSR is over 15% too. You didn’t really say too much about investments, retirement savings, and pensions. I assume those would be included as part of your PSR, right? If that is the case, then I’m pretty confident that my PSR is indeed in the above 15% category.

I used to keep a really detailed budget and track every receipt and expense but lately I’ve just been focusing my efforts on keeping my costs low, researching all my purchases, getting great deals, and enjoying life. Then, I keep an eye on my bank account after paying myself for retirement first and as long as the numbers keep increasing and my net worth keeps increasing, I’m happy!

That’s pretty cool. I have no idea what mine is. We track our income/expenses on Quicken.

Since I set aside 15% of my pre-tax income for 401k, I assume I’m above 15%, but I don’t know how far.

I love the idea of this article. The thing I do though is make my savings as part of my expenses. My ‘savings’ is about 14.9% of my after tax income but I’m thinking in August to make it 15% of my before tax dollars. I also save additional 20% of my income for RSP, an emergency fund and a car fund. All of which I consider expenses as well.

It’s nice to think you add up your income and substract all your expenses and that is how much you can save but if you don’t pay yourself first that extra ‘$40’ month goes to other place… other wants because look I have an extra $40.

Since my 401K is getting 10% of gross, and one of my pension checks goes directly into savings, I’m at about 12% that goes directly into savings without my ever seeing the money.

However, since I mentioned the word “pension”, obviously I am collecting/withdrawing on one even while still working parttime and contributing to others, so I don’t know how you’d figure that in 🙂

So what am I planning on for retirement in 2 yrs? A 401K, the small pension already collecting on from a deceased spouse, my small pension from previous job, two separate IRA’s, dividend producing investment account, and at age 60 I plan on grabbing Social Security Survivor’s Benefits – that’s 2.5 years from now. In the meantime, the parttime job is paying for my health insurance, which I’ll have to pay for between 60 and 65 when medicare kicks in. Oh yes – and I need to keep debt free including no mortgages… that’s the biggie.

Marci357 said they key phrase – “keep debt free”. Nothing eats away at your personal savings rate more than expensive debt. If you’re carrying expensive credit card debt now, I would dedicate yourself wholly to eliminating that debt. Once you’ve rid yourself of high interest rates and monthly debt repayments, you can take all that newfound cash and put it towards your savings. Typically, you’ll pay more in interest that you’ll earn in interest, so net/net, you’ll be at a loss until your debts are paid. And it’s just as fun to watch your debt totals drop as it is to watch your PSR rise!

Savings and the art of saving are at the root and result of many good habits – even beyond financial security and wealth. It is important and helpful to use indicators like the PSR to really judge your successes and failures and make adjustments. It’s interesting how applying a “grade” to an effort often produces better results.

[…] comes up with another great article on saving money and understanding your Personal Savings Rate […]

When we calculate our monthly spending, do we deduct the contributions we make to things like an RRSP or TFSA if it’s not borrowed?

Individual transactions are done using MS Money (I LOVE THAT Software, so much easier to use than Quicken) & house hold budgeting is done via google spreadsheets so that everyone can see what’s going on and where the money currently stands.

[…] Personal savings rate of 35-40% […]

So, if you save $1000. but decide to spend it on paying down your mortgage early… that gives you a worse PSR… right?

But it can actually do good things for your net worth… and eventually your savings rate.

Is there any provision for this within the calculations used by gov’t agencies and the like? It seems like, with all the recent de-leveraging, people might be sacrificing saving for paying down debt… which seems like a good thing. Thoughts?

Great Article,

I calculated my savings rate and started making spending decisions based on my rate. I now look at the savings rate with and without my 401k contributions, To Dennis’s point on paying down a debt, that is still an expense and it does help net worth but it is not savings.

I found it easier to use my beginning and end of month bank account balance rather than using expenses.