Fridays were always the best lunch days at school. Without peeking into my blue Smurfs lunchbox, I knew my special end-of-week treat would be packed with care.

Other kids got Twinkies, MoonPies, and Wagon Wheels. But not me. Sure, it was the 80s and Hostess cellophane-wrapped treats were cool from Monday to Thursday, but Fridays were reserved for the tastiest and rarest of rewards.

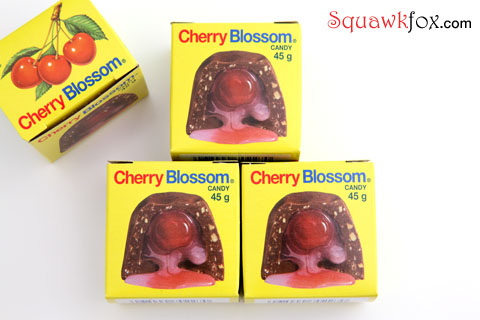

Enter the Lowney Cherry Blossom — a chocolate-wrapped maraschino cherry embalmed in sweet syrup and surrounded by a mixture of coconut bits and roasted peanut pieces. A cube of sugary heaven boxed in yellow and wrapped in tinfoil. Biting into one always sent a stream of gooey goodness down my chin, shortly after the sharp snap of bursting chunky chocolate. Sigh.

The anticipation of opening my Smurfette-clad lunch kit and spying a sweet yellow box got me through the tedium of morning math class and the isolation of recess. The other kids didn’t get me, which was totally OK ’cause I knew that when the noon bell rang, I would be holding my prized confection of the week.

Opening my Smurfy lunchbox required skill. The blue plastic latches were fragile from years of use, and that dang ‘Flip’n Sip’ Thermos could roll without warning, smushing my tuna fish sandwich. Smashing my Cherry Blossom would have been the worst. That yellow box had to be preserved at all costs.

With the lunchbox lid popped open and my sandwich saved from the gloopy soup served in the leaking Thermos, I did what few kids would do: I pocketed my chocolate treat. My worn raincoat had a secret fabric tear, the perfect place to shroud my dessert from the hungry eyes of greedy bullies.

Friday after school was the best time of the week. Free from the confines of the school bus I’d skip home and bound up the stairs to my bedroom. I was alone to enjoy the contents of that little yellow box.

After examining the box for dented corners and stained cardboard (dang leaky soup), I did what few kids would do: I added my sweet to a secret stash of identical yellow-boxed treats, all hidden in a hope chest beside my bed. Over several agonizing months of chocolate-free Fridays I had managed to save a stack of eight delicious Cherry Blossoms.

Building pyramids with them was fun. I’d line ’em up in rows, make grids, and play imaginary games of Pac-Man to protect them from evil ghosts. Taking one from the bottom and putting it on top was my budget version of that Jenga game, only my blocks were more delicious.

I suppose my goal was to save 12 yellow boxes and share the spoils with family and friends. But deep down, in my taste bud deprived state, I think I just liked watching the pile grow. Seeing all my Cherry Blossoms lined up was like a potential party in my mouth, and dreaming of the day I’d actually consume one (or all eight) was the reward unto itself.

The Cost of Collecting

What price are you paying to stockpile stuff? A humerous read on The Cost of Collecting.

But alas, all good things (and Jenga games) come to an end, and children with secret things hidden in hope chests often get busted by nosey parents. And Blossom-busted I was.

My mom didn’t see the humor in my secret chocolate stash. Nope. She likely saw a child who didn’t eat her lunch, a kid who failed to appreciate an expensive treat packed in a lunchbox with love, and a school girl who was (at best) a little bit weird.

Only the weird part was true. Too bad mom hadn’t heard of Stanford scientist Walter Mischel.

Mischel’s Marshmallows

Walter Mischel must have loved tormenting kids with marshmallows, ’cause in 1972 he devised a delicious psychoanalytic experiment that tested the will and fortitude of preschool children.

In a room surrounded by video cameras, Mischel offered each child a single marshmallow. The kid was given two options — either eat the marshmallow now, or wait and be rewarded with a second one later. Mischel then left each kid alone for 15 minutes. Some kids caved and ate that enticing marshmallow, while others agonized and waited for the second hit of sugar.

Of the 600 children who took part in the experiment, one-third deferred gratification long enough to get the second treat. Videos of the actual experiment and reenactments are hilarious, and a little bitter sweet.

After tracking these kids years later, Mischel found an unexpected correlation between the results of the marshmallow test and the success of the children in adulthood. The kids who were able to delay gratification had fewer behavioral issues, stronger friendships, and higher SAT scores. Brain differences in 2011 fMRI scans were visible, correlating to how these kids did on the marshmallow test decades earlier.

I’d love for Walter Mischel to comment on my Cherry Blossom hoard and fMRI my brain. He’d probably image visions of stacked denim jeans, see a penchant for Fluevog shoes, discover my strong sense of compound interest (even in times of low interest rates), and grasp my insane ability to save money.

Take that, mom.

So where am I going with this?

Teaching kids how to wait can be good for their brains, behavioral actions, future bank accounts, and even SAT scores. Demonstrating your own ability to delay gratification around your kids ain’t a bad idea either. Heck, even those without kiddlets can benefit from thinking things through before pulling the ‘spend’ trigger.

Some things that helped me along the way to waiting patiently:

1. Interrupting others was not allowed. Budding into a conversation to hear my own voice was never permitted. I was told to wait my turn, and asked to apologize for being rude.

2. Earning money was a must. Household chores when I was young, paper routes when I could walk, and 8-hour shifts at Tim Horton’s when I was older taught me the value of earning a dollar. Money didn’t grow on trees or spew magically from ATMs. Money grew by vacuuming the house, delivering newspapers, and selling donuts.

3. Opening a bank account makes money real. At the tender age of ‘sooo long ago I can’t remember’, my mom took me to the bank and helped me open my first savings account. I was encouraged to save a portion of my ‘chore money’ every month, and I watched my money grow. Emphasis on MY MONEY. The magical power of compound interest was explained. Good things come to those who save and wait.

4. Spending taught prioritization. Never one to lavish me with every toy on a whim, my mom showed me how to withdraw my saved moolah from the bank, and taught me how to spend my hard-earned cents on something special. Because I had to hand my money over to the cashier, I saw first hand how many quarters it cost to buy that pink Yo-Yo. I equated the number of completed chores it took to earn a particular toy. I often passed on the spend, in favor of saving for something bigger. Priorities, people.

5. Setting goals helps you reach them. It’s a long road to toe if you don’t know where you’re going, and one can lose the way without a proper map. Loosing my secret stash of Cherry Blossoms taught me it’s sometimes better to enjoy a few spoils today — you don’t need to collect the whole dang set.

How to Set Financial Goals

Download these three free worksheets to help achieve your financial goals sooner.

Now excuse me while I Google around for vintage Smurfs lunchboxes. I have a hankering for Cherry Blossoms, and I intend to eat the lot.

Your Turn: Would you have eaten the marshmallow as a kid?

Love,

Kerry

I probably would’ve eaten the marshmallows. My parents really didn’t teach us how to manage our finances. I had to learn the hard way, as an adult. But with my kids, from the age of 3, for each of them, we’ve always had them earn their allowance, and buy their own toys, candy, movie tickets. They would get toys and such for birthdays and Christmas, but if there was something they wanted while at the store, I would just ask them “do you have your money with you?”

Now that they’re teens, when they come to me with something much more expensive they want, we’ll split the cost, if I think it’s worthwhile. But they have to come up with half before I’ll chip in my half. That usually helps them sort through what’s really important.

I don’t know, honestly: It’d be a toss-up. I’m not sure I’d like two marshmallows enough to wait for the second one, although I’m pretty sure if it were some other candy I’d be willing to sit through it.

My parents never consciously taught me any money skills, but when I started making my own money, I never made any truly disastrous mistakes (spent more than I had–never; spent more than I should’ve–yes, sometimes). I knew enough about money to know that I only had so many dollars left to the month, and that spending more than that was not good. It flummoxes me when I hear about adults who literally don’t know where their money is going.

I used to save my favourite sweets up – it was always the lolly pop if I got a bag of them. Then one day (I was around 4) I had a bag of sweeties and and my mum made me give the big, beautifully coloured lolly that I’d been saving to my friend, who WOULD have to pick my favourite! After that, delayed gratification seemed a bad idea and I always have the best bits first 😉

Seriously though, in financial terms I’m an averagely good saver – I have a kind of subconscious accountant who doesn’t let me go overboard on payday. The trick is to FEEL like you’re being a bit naughty, I find, but my inner accountant knows that I’ll be fine by the end of the month really.

It breaks my heart to hear that your mom was so strict that she took away those chocolates! I’m not a mom, but I’d like to think that I’d be so proud of the self-restraint it would take my child to not eat them…As a parent — what would you do if you found that your Chloe followed in your footsteps?

I am happy to hear that you learned a valuable lesson in enjoying the fruits of your labour — eating chocolates on a Friday!

If I was positive that the 2nd one would be given just for waiting, I’d wait. Still would 🙂 lol

Are you my soul-sister??? I too have love of Cherry Blossoms AND Fluevog Shoes!!! As for the marshmallow – only like them in smores… but if the experiment was with chocolate, well that may have been a different outcome. I’d like to think I would’ve waited, but I’m not so sure.

I would have waited for the second marshmallow. My daughters and I spent 4 years working and saving for a trip to Europe which was well worth it. They will also wait for the second marshmallow, the fruition of the big dream far outweighs the momentary thrill of money out the window.

I think if your mom had understood why you were saving them she would have been more empathetic (but as an adult I bet you see her side too!). I was a saver, always was. My kids are too. We still have Halloween candy (although most of it has been tossed surreptitiously) and my kids don’t mind saving for things. Interestingly, when they come to me for help with buying things, it is always for each other (“Mom, can I use my allowance to buy this for my sister?”) so either I am really lucky or am doing something right. I wonder, as much as I want to pat myself on the back for it, if there might be a genetic component to this?

I love this! What a determined young child you were. We all had bank accounts from very young ages, too, and it helped us keep our money safe and watch it grow over time. I especially loved realizing I earned interest on that money – I get paid just for having money?! This is great! Thanks for sharing!

This experiment is not just about delayed gratification, but also about trust. The child has to be trusting that this random adult will carry through on their promise, and that nothing will happen to their first marshmallow if they wait. Perhaps it is the trusting nature that lead to stronger friendships and fewer behavioral problems, not just the self-restraint.

Do you still like Cherry Blossoms? I loved them as I kid, and I still have one occasionally, but I find the chocolate quality is not as good now. In fact, the box used to say “chocolate” and now it says “candy”!

I probably would have eaten the marshmallow, although it’s hard to say… would have depended on how far away my dad was. He used to take Hallowe’en candy from my brother and me until we learned to hide it. (I’m not telling where!)

I have had very bad issues with money in the past, and paid off my $18K of credit card debt in 2005. I am learning to improve by living on $7,000 a year, my self-employment income (I have no housing costs, I live with my elderly mom) and no credit cards. I have done the latter for nearly 7 years now, and have been earning the income mentioned since the middle of 2008. My small business is growing, though and I may crack the $8,000 barrier in income earned this year. When I get up to $10K, my bank says I may have a $500 credit card. I have done well without them, all the same, and may still not get one when I reach the minimum income level.

My favourite treats are the ones I make myself – shortbread cookies and white chocolate almond bark.

This is a great example! I saw another great teaching moment in a grocery store the other day. A dad with two young kids was at the checkout, when his older boy picked up a candy bar and asked if he could have it.

The dad’s reply was great, he said, “Well, you earned some money working around the house, so you can buy it if you want to. But remember the Legos you wanted? If you spend your money on candy you’ll have to save that much longer to buy your Legos.”

I almost applauded as the boy put the candy bar back and decided to save his money. Hurrah for responsible parents!

Awesome article Kerry! Love it! I shall show this to my brother-in-law in Toronto who just loves ‘Cherry Blossoms’. I just prefer chocolate never did like the gooey in the cherry blossoms! Hugs to you! 🙂

I did that with lemon K-bars when I was about 11 – I saved one a week for 3 months – ended up with 13 – one day I was just going to eat a half a one then all of a suddent they were all gone.

So far, in my opinion, Tiffany, Cathleen, Christine, Connie and Charlotte have hit the nail on the head. Parents provide the necessities and birthdays and Christmas and working for $$$ above and beyond normal duties give the child/teen ways to make financial decisions. That is IF….

If the parents are trust worthy AND provide basic food, clothes, and shelter, and support in education!

In my teen years, birthday spending was $50 and Christmas was $200. My brother deferred for 5 years and was able to put down the down payment for a car that he made payments on. This gave him freedom to work and date and got him to and from college. And he did pretty good on the trade in, a Camaro, vroom!

I worked in a summer camp for 7 years; my daughter, K- 6 grade was a camper. I made her lunch and paid her $.50/hour to be a helpful camper, not a complainer. So $.50 times 10 hours/day times 4 days/week times 10 weeks of camp equals $200 times 7 years……. equals what?? for a 13 year old?

And yes, I was trustful; I paid her and helped her set up a savings account.

Maybe we are preaching to the choir here.

She was so careful with her money. She only spent a tiny bit at Disney Land, our end of the suummer trip and half the time used her money to buy her best friend a present.

And yes she does have a high IQ. Would any one need a name of a good brain surgeon?