Want to know the impact of current mortgage rates on your mortgage? Think it’s time to refinance? Or maybe you’re looking for your first home and want to calculate your mortgage payments. But before calling your bank and signing your moolah away on a mortgage, do the math yourself to see if you can handle the financial reality of a new or refinanced mortgage.

You might just be surprised with how much interest you’ll be paying with the wrong mortgage rate or be buried by the debt of a too pricy piece of property. It pays to do the math before falling in love with a home.

Use the Mortgage Calculator to:

- Learn how mortgage rates impact your mortgage payments.

- Evaluate if you’re ready for a mortgage refinance.

- Calculate monthly, weekly, or twice weekly payment schedules.

- Calculate mortgage rates, total payments, and total interest paid.

- Run the Mortgage Report to see how changing payment schedules lessens (or increases) the amount of interest paid.

- Make smarter financial decisions based on hard financial facts. You can’t argue with the mortgage calculator numbers. 🙂

How to use the Mortgage Calculator:

Step 1. Open the Mortgage Calculator.

Step 2. Mortgage Amount: Enter the total amount for your mortgage (for example: 325000).

Step 3. Term: Enter the length of the mortgage term. From the drop-down list, select the term duration (for example: Months or Years).

Step 4. Mortgage Rates: Enter your current mortgage rate.

Step 5. Payment Period: From the drop-down list, select the preferred payment period (for example: Monthly, Twice Monthly, Every Two Weeks, or Weekly).

Step 6. Click Calculate. Mortgage payments and mortgage rate results are calculated and display below. View number of mortgage payments, total mortgage paid with principal and interest, and total mortgage interest paid.

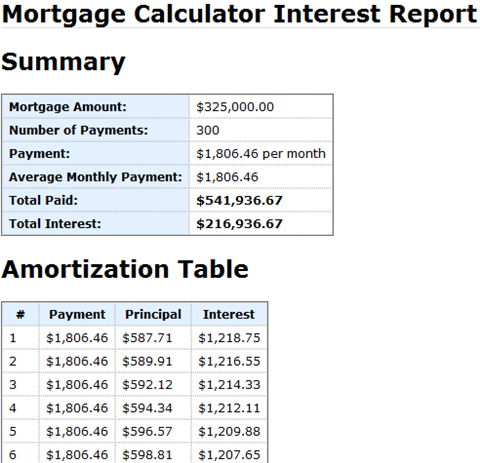

Step 7. Click View Report. A detailed Mortgage Calculator Interest Report opens.

Use this Mortgage Calculator Interest Report and Amortization Table to better understand the impact of current mortgage rates, to see how changes in mortgage payment schedules can lower or raise your interest costs, and to do the math before buying a too pricey piece of property.

Carl and I made this Mortgage Calculator just for you, so give it a try and use it as tool to keep you mortgage smart. Because banks are rarely our friends when it comes to signing up for a mortgage I think it’s best to take the initiative and DO THE MATH before shopping for a home or signing up for that so-called sweet mortgage rate. Lastly, before signing on the dotted line be sure to consider your total consumer debt and add your debt repayment to your monthly costs. You don’t want to get sunk by your dream home and turn the roof over your head into a nightmare.

Nice calculator. Another silly stat i like to calculate is how much of every dollar paid goes to interest vs. mortgage right now. I used that tool to show coworkers how just a little more now saves lots later.

I wanted to see a minimum of $0.50 on the dollar to principal before i bought a new house. Currently just over $0.85 per dollar going to principal thanks to our ‘free’ interest rates!

DH

Ooh what a cool idea! Also congrats on placing third 🙂

Love your calculator. Do you have any advice on how to find a financial advisor/income tax preparer in B.C.?

Your mortgage calculator does not calculate correctly.

Canadian mortgages compound semi-annually and not monthly. In the above example, the actual monthly payment should be $1,798.79 and if it were paid weekly it would be ¼ of that or $449.70/week.

@Tax Guy It depends on your mortgage and if you’re American or Canadian. In Canada, mortgages are compounded semi-annually with the exception of variable rate mortgages which are generally compounded monthly. In the US mortgages are generally compounded monthly. Also, the example calculator you link only assumes fixed rate, so consumers are painted a rosier picture. In my next update I’ll add an option to compound monthly or semi-annually for flexibility. Thanks!